how I came to terms with the whole NFT thing.

disclaimer:

This article is by no means an invitation to use crypto assets. It explains the thought process I went through to make peace with this block of technology.

If anything, it’s an invitation to remain critical, take your time, make your research and make your own opinion.

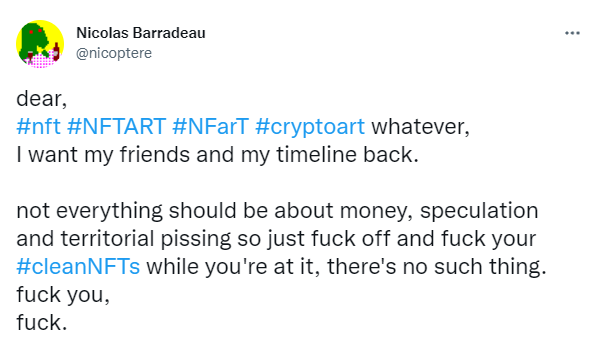

last march, I got pissed and vocal like I rarely do and it was about NFTs

https://twitter.com/nicoptere/status/1370472989930758157

https://twitter.com/nicoptere/status/1370472989930758157

why so pissed?

how it started: Beeple’s record crypto sale.

Beeple is a flagship for the creative community, he consistently made art every day for over a decade which granted him the status of living legend amongst us mere mortals.

then BOOM!

overnight, every second person I followed on Twitter started talking almost exclusively about NFTs, where to buy their stuff, for how much, how they would ‘drop’, how we should be ready, reposting links to their collections etc.

would it have happened with regular money? very unlikely.

would the NFT expansion have happened anyway, it’s reasonable to think so, a dynamic was on its way for a while (and for good reasons), there was this tiny ecological concern at first that found a reasonable compromise by replacing the blockchains using PoW (Bitcoin and Etherum) with a blockchain using PoS (Tezos).

Shortly after of course, the Beeple sale’s varnish started cracking as we put it in french (the sale appeared for what it was: a crypto-stunt) but this was of no importance, a new paradigm was on its way.

My position on the subject of cryptocurrencies has not changed and is broadly aligned with Stephen Diehl’s, here’s the podcast (and, yes, you should follow Tech won’t save us!)

The concept of cryptocurrencies (supranational deregulated money) goes against all my convictions, beyond their ecological impact, beyond the underlying techno-libertarian ideology willing to turn everything into a product and everyone into a company, they’re “a solution in search of a problem”, they solve nothing that can’t be solved otherwise in more effective ways.

They’re intrinsically broken ; the PoW gives power to the already powerful (entities with the biggest compute power take the cake and get rewarded), the PoS gives power to the wealthiest (the more Stakes you hold, the more likely you are to validate and get a split of the next transaction).

Crypto assets are a zero-sum game: in short, you need people to invest actual (fiat) money if you want to earn something. That’s why the crypto enthusiasts are so loud: they need other people to invest funds into the cryptocurrency to increase its value. You can think of it as a pyramid scheme, because it is one.

Where the attention economy meets the FOMO economy

The fact that NFTs are backed by crypto assets plays on a positive bias that leads artists and buyers to believe they’ll gain more than they invest, it creates a form of addiction that is very comparable to gambling.

Limited series and auctions act as a gambling mechanic (bets) which – associated with the impossibility to get the positive feedback produced by the compulsive buying of something – creates a strong Fear Of Missing Out (FOMO).

FOMO is the mechanism that powers the Crypto/Web3 economic model.

It takes the attention economy for granted as everything will happen in closed rooms (metaverse, app, social media…), where everyone will know what others possess, thanks to the transparent ledger (the backbone of blockchains). Ultimately, everything (good and services) should become a FOMO-driven pay-to-play slot machine.

The phenomenon is made possible and reinforced by the fact that “it’s not actual money”, once you’ve converted some fiat money into a crypto currency, it becomes like trading marbles in a schoolyard. The value of a marble is not based on real economy (anyway, parents usually pay for it) but rather agreed upon within the schoolyard, often based on its scarcity.

For instance, as a kid, the “water drop-galaxy-petroleum” marbles were extremely rare (I’ve seen only a handful of them in my lifetime), you could trade them for basically anything, from large amounts of lesser valued marbles to bigger toys that had nothing to do with marbles.

This value is highly volatile and over the course of 3 weeks – a lifetime in a schoolyard – a given type of marble could skyrocket or crash down on the market, with no relation to their intrinsic value.

“the winner takes it all” (ABBA).

Well known artists that played along are the main beneficiaries of this dynamic. If you don’t already have a solid network of artists and potential buyers, don’t quit your day job.

I think this caused a lot of harm amongst newcomers already but I witnessed fine people turning into brands or media (or what qualifies as gurus), the logical next step is to create Personal Tokens (it’s already a thing).

The merchandisation of an artistic production pushes artists to be easily identifiable as “the person who does X” and, should success happen, they tend to reproduce and develop the ‘style’ that worked or at least explore less and take less risks which – imho – impacts their overall creativity.

“milking the sacred cow” (Dead Kenndys)

Creative coding is a very broad topic. When I started Grow, I wanted to show how rich the creative coding field was and invited people who use code to make art in all possible directions.

As a (fine-arts) student, one of my teachers kept repeating “the most useful tool is the trash bin” which translates to “uncurated generator outcomes are trash”. With this new paradigm, it is tempting for the community to reuse the same old tricks and create series, it’s rarely interesting as the pieces are not meant to work as series. It’s often openly aimed at selling or increasing the mediatic surface and always produces a lot of noise.

“territorial pissing” (Nirvana)

The collectors’ side:

I got my hands on X from Y

I’m SO excited to have bought Z on secondary

If you’re an appreciative collector who supports artists, “supporting artists” is the payload. Spending money is not a skill, so toss your coin and be quiet about it.

The artists’ side:

Some people I immensely respect unearthed decades old sketches to mint them as NFTs.

So what? you may wonder, well that’s the closest we had to a cultural heritage.

when you saw a given piece of procedural / generative animation or artwork, you’d know who did it and there was no way one could possibly claim the ownership without being debunked and frowned upon (at best).

This involves and favors a sense of community, liability, awareness, modesty and respect.

replacing this dynamic with a transparent, disembodied, trustless and merchant transaction makes me utterly sad.

copycats & scalpers

copycats: usurp artists’ identity and create (mint) copies of their artworks in their stead.

scalpers: bots that collect items on the primary market in order to resell them on the secondary market with a bonus (on fxHash, I saw a casual x 2000 for a piece by Casey Reas).

seriously, fuck these guys.

pinky swear

In most countries, there are ways to certify the intellectual property of a given item, even in its digital form. It’s tedious but if someone tries to steal your work, you can bring your case to court and win.

fun fact: in France, it would cost me 15€ and I’d have to send 2 copies of the artwork, by mail, to the SCAM (I kid you not: Société Civile des Auteurs Multimédia)

The notion of intellectual property doesn’t exists in the NFT world, yet again, it is fundamentally broken and doesn’t solve anything (says the NFT inventor), and certainly not the ownership of a digital asset hence the – rather funny – “right-click” meme that makes some crypto bros & sis lose it.

On a side note, DRMs address the ownership of digital items (if you’re old enough to know what it is).

In a schoolyard, this is called pinky swear, so, in essence a NFT is trading marbles for a pinky promise

[ I could go on and on and on ]

I was so appalled, so pissed, sad and even angry at some friends for not seeing things as I did… This is a house of cards and by no means a long term solution to… anything!

I was already aggressively blocking advertising (like “custom chrome extension on top of all possible ad-blockers” aggressively) so I added a couple more keywords and my twitter fell almost silent and it felt good.

Then I got very busy with my work at the GAC lab and didn’t have time to research further, everything I read made me physically sick anyway.

Coming to terms

At the end of 2021, 8 months later, things had sunk in a bit and I came back to the subject.

Obviously the first step was to remove the filters from my twitter feed, the spring craze had vanished, it was easier to breeze, I found people more casual about the whole NFT thing. HEN (hic et nunc) had become the de facto platform for Artistic NFTs, they had pulled off something rather impressive, hundreds of thousands of artworks lived on the platform despite numerous shortcomings. As expected, It was Deviant Art with price tags but it worked.

Mid november 2021, the platform abruptly shut down for many reasons. Matt DesLauriers wrote an informed and balanced article about the incident (Hicetnunc and the Merits of Web3). The main point is that, unlike when a web2 platform shuts down, alternative websites could make the contents accessible shortly after HEN went down, which somehow advocates favorably for Web3.

It still find the:

“I do believe Rafael cared about the art and a social cause, but was constantly distracted and eventually worn out by people calling him names, belittling him, and harassing him to give up his website to the ‘community.’”

part of Violet_Forest’s statement, a bit hard to take.

“money” (Pink Floyd)

Then I learnt about what money is and realized how little I knew about the subject (I liked this intro). I learnt about the Nixon Shock, the original sin of the modern economy. I discovered the various faces and use cases of cryptocurrencies (utility tokens, payment tokens, stablecoins, asset tokens…), this helped me understand that it’s more subtle than just a massive scam and though I still see it as a convenient way to circumvent regulations, I can understand why people believe (and invest) in them.

It also confirmed that I’ll never be a banker and the key takeaway is: “do not invest what you can’t afford to lose”

art is special

In the podcast by Stephen Diehl around minute 34, he compares the crypto assets to the traditional economy system, with the monetary, security and commodity classes then he adds a fourth class: “the alternatives: art.” which value depends on “whatever someone is going to pay for it”.

I’m French and Art is a religion in my country. When I say it’s a religion, I mean an actual religion with cathedrals, churches, saints, temples, priests, ceremonies and gatekeepers. We are often seen as pedantic but we’re just culturally biased, this allowed for memorable discussions about “what is art”. In my case it’s even worse: having been a fine-arts student, I make a clear distinction between art on one hand and: “graphic design / illustration / other creative activities”. I may be creative but I am not an artist: my work is not to make art and to that extent, most people in the NFT space are not artists either, they’re hobbyists (which is fine). For convenience, I now use the label artists in a broader sense, like everyone else in that space.

All this to say that buying Art in France is encouraged and up to 100% of any artwork one buys is deducted from their taxes, the “NFT art is a money laundering machine” argument may be valid but it’s a mere reflection of the pre-NFT art world.

Art lies a bit outside of the crypto/web3 equation of doom. Speculative by nature, the art value has a long history of scandals, scams, frauds and trolls, nothing new here.

Circa 2003, Damien Hirst famously bought back his own artworks to artificially increase their value. If hype artificially inflates the prices of something, if the market is still driven by big names, so long for the game changing promise of NFTs but also, “so what?”.

From there on, I read a series of articles for and against NFTs to make a somewhat informed decision (they’re listed at the bottom of the page) and as I was already sold to the con clan, I tried to keep an open mind and see the glass half full.

the mere exposure effect

In short, something ugly becomes familiar and likable when you are regularly exposed to it.

This definitely played a role. When I was pissed, I’d notice every mention of the word, roll my eyes and skip to the next message. Eight months later, the mechanic had been ‘integrated’, the ‘user experience’ of the NFTs’ promotion was smoother. I got used to it and found it less ugly, like my grandparents’ brown-ish wallpaper I got used to over the years.

clean NFTS are actually … clean.

Shortly after the first reads (Joannie, Memo), I understood that the Tezos transactions are light to compute and reasonably green. There is still an ecological impact of course, servers need to compute the transactions, servers need to serve the files but I guess this is how the internet works. I’m not hosting my files yet but I may well start an IPFS node to store and share my own works, just to know where the electricity comes from.

It also means I’ll stick to Tezos, knowing how much of a shitstorm the other blockchains are, I can’t decently trade in ETH or BTC or anything equally ecocidal. I know Etherum is supposed to switch to PoS, until it’s done, I’ll stick to Tezos, really.

Unlike crypto bros & sis, artists question the medium, this article explains how environmental concerns emerged in parallel to the rise of Art NFTs. Joannie Lemercier is an example of integrity in that field.

artists making a living, serendipity and new faces

Even at my pissed-iest, I’ve always been ok with one thing: crypto or not, artists get rewarded for their work and it’s a good thing. I saw not only talented artists take off but also many people with qualitative daily works get noticed and validated or even become full time artists. This couldn’t have happened in any other context.

This is why NFTs were invented, the state of affairs that kickstarted the NFTs adventure is that all the Tumblrs, Instagrams, Twitters, Facebooks would (very literally) feed on artists without giving back shit. These networks are based on the attention economy, they need fresh content to keep users hooked as long as possible to sell advertising. Without the artist’s contents, these platforms would appear for what they are: empty shells.

One of the reproaches I’d gladly throw at NFTs is that they use marbles instead of actual (fiat) money. I don’t like the idea of private collections yet for the past years, I tried to support artists by buying some of their pieces (usually prints). I‘m against all forms of accumulation and it hurts to think that the new pieces I’d buy would end up in a garage instead of living their lives hanging on walls.

Every time I opened HEN, I found something that caught my eye and much more often than on Twitter (which is my only social network). The energy and the variety of the works really touched me and I felt stupid for not even taking a look earlier.

I also read an interview of Thierry Ehrmann (the guy from Artprice.com) who said that women, “emergent countries” artists and street artists (ephemeral by nature) were benefiting from the NFT system, this moved me a lot and though things are not okay yet, they’re somehow improving.

After realizing I hadn’t spent a single cent on art for a whole year, clicking the ‘like’ button of twitter felt weird and the perspective of being able to send “something” to someone in return for moving me with their work felt good, the best part being that the artworks live online and won’t rot in my garage, I don’t even own them!

This is what pushed me to open a crypto wallet and purchase some Tezos.

FX HASH and family pressure

The last nail in the coffin was Fx_Hash. It is a creative coding platform that uses the buyer’s hash to seed a PRNG. Creative coding has been my passion for 20 years, I never considered myself an artist but a creative coder, most definitely!

There have always been numerous REPL sandboxes around, the oldest I’m aware of (and took part in circa 2010) was WonderFL, some of the best sketches still live on https://beautifl.net/. It was in Flash, I was a Flash dev and Processing required a (poorly supported) Java plugin to run inside a web browser so https://openprocessing.org/ was a bit confidential (btw, they do NFTs too now).

I learnt a lot from some of the mind boggling demos you could find there or more recently on Codepen, Shadertoy, Glitch and what not, the code is visible, it’s important to discover, learn and improve. Plus, @ciphrd is very skilled, very reactive and makes a lot of right decisions fast to improve the platform. As more and more of my friends were giving fx_hash a spin, the FOMO got stronger because they‘re more than friends, they’re cousins, they’re family. This platform may well be the way for me to earn the marbles that will let me reward other artists’ work.

finishing this long article

My early critics still hold true and I didn’t turn into a crypto unicorn. The whole crypto thing is a zero-sum, pyramid scheme and I willingly injected money into it. I’m not planning to inject more and I’m not planning to convert anything back, anyway at the time of writing, the Tezos I bought 6 weeks ago lost ~55% of their value. I knew it was likely to happen, maybe they’ll be worth 10 times more in 3 months, I don’t care, the plan was never to benefit from it myself but rather to try to modestly send them towards artists who may benefit from it.

I believe that, beyond stamping JPGs, it is important for artists to use the smart contract themselves as an artistic medium (here’s the doc).

There’s still a lot to address before NFTs become even remotely likable but for now, I’ll stick to my plan: try to make tezos with what I’m supposedly good at and support artists as much as I can.

thanks for reading.

who to follow

✊https://twitter.com/artur0castro

😑https://web3isgoinggreat.com/

🍿https://twitter.com/CoinersTakingLs

reading list ( in no specific order )

Anil Dash NFTs Weren’t Supposed to End Like This

Everest Pipkin HERE IS THE ARTICLE YOU CAN SEND TO PEOPLE WHEN THEY SAY “BUT THE ENVIRONMENTAL ISSUES WITH CRYPTOART WILL BE SOLVED SOON, RIGHT?”

Memo Akten The Unreasonable Ecological Cost of #CryptoArt (Part 1)

joannie Lemercier The problem of (Ethereum) CryptoArt

Jake Rusher WHAT DOES IT MEAN TO BUY A GIF?

Matt DesLauriers:

on crypto art and NFTs < excellent intro to NFTs

Hicetnunc and the Merits of Web3

Antstyle Why NFTs are bad: the short version & Why NFTs are bad: the long version

Martin O’Leary The case against crypto

Laurie Voss Crypto: the good, the bad and the ugly

Moxie Marlinspike My first impressions of web3

Thierry Ehrmann (the artprice.com guy) Artmarket.com: For a classification of NFTs on marketplaces and in Artprice database